Alan Greenspan: The Man Who Shaped Modern Economics

So here's the deal, folks. You probably heard the name Alan Greenspan tossed around in financial circles, maybe on CNBC or Bloomberg. But who exactly is this guy, and why does he matter so much? Well, buckle up because we're diving deep into the life and legacy of a man who played a pivotal role in shaping the global economy as we know it today. Alan Greenspan isn't just some random economist; he's a legend whose decisions affected millions, including you and me. Let me tell you, this dude’s story is as fascinating as it gets.

Let’s break it down. Alan Greenspan served as the Chairman of the Federal Reserve for an unprecedented 18 years, from 1987 to 2006. That’s longer than any other chairperson in Fed history. Think about that for a second. For nearly two decades, this guy was at the helm of one of the most powerful financial institutions in the world. His influence stretched far beyond the borders of the United States, impacting economies worldwide. But how did he get there, and what impact did he leave behind? Stick around, because we’re about to uncover all that and more.

Here’s the thing, though. While Greenspan’s tenure was marked by incredible economic growth, it wasn’t without controversy. Some argue his policies contributed to the 2008 financial crisis, which, let’s face it, was a massive deal. Others credit him with steering the U.S. economy through some pretty rough patches, like the dot-com bubble burst and 9/11. So, yeah, this guy’s legacy is a mixed bag, but one thing’s for sure—he’s someone worth learning about. Now, let’s dive into the details.

- Larry Bird Wife And Family The Untold Story Behind The Nba Legends Personal Life

- Movies Joy Your Ultimate Guide To Discovering Cinema Bliss

Table of Contents

- Biography

- Early Life and Education

- Career Highlights

- The Federal Reserve Years

- Key Policies and Decisions

- Controversies and Criticisms

- Greenspan's Legacy

- Global Influence

- Books and Publications

- Conclusion

Biography

Alright, so before we dive into the nitty-gritty, let’s get a quick snapshot of the man himself. Alan Greenspan was born on March 6, 1926, in New York City. He’s one of those old-school economists who started out as a jazz saxophonist before finding his true calling in finance. Yeah, you read that right—jazz saxophonist. Who would’ve thought, right? But hey, life’s full of surprises.

Below is a quick glance at Greenspan's personal and professional life:

| Full Name | Alan Greenspan |

|---|---|

| Date of Birth | March 6, 1926 |

| Place of Birth | New York City, USA |

| Profession | Economist, Federal Reserve Chairman |

| Education | Bachelor's in Economics from New York University |

| Notable Positions | Chairman of the Federal Reserve (1987–2006) |

| Spouse | Andrea Mitchell (Journalist) |

Early Life and Education

So, Greenspan wasn’t always the financial wizard we know today. Back in the day, he was just a kid growing up in Washington Heights, New York. His parents divorced when he was young, and he spent much of his childhood living with his mother. Now, here’s where it gets interesting—Greenspan was a musical prodigy. He picked up the saxophone at a young age and even attended the Juilliard School for a while. Can you imagine? The guy who would go on to shape global monetary policy was once rocking out with a saxophone. Life’s funny like that.

- Is Josh Gates Married The Truth Behind The Mystery

- Marina Pearl Leblanc The Rising Star Of Modern Entertainment

Eventually, Greenspan realized economics was his true passion. He enrolled at New York University, where he earned a bachelor’s degree in economics. Later, he went on to earn a master’s degree from the same institution. Fun fact: Greenspan never completed his Ph.D., but that didn’t stop him from becoming one of the most respected economists in the world. Some people just don’t need that piece of paper, you know?

Career Highlights

Greenspan’s career path is nothing short of impressive. After graduating, he worked as an economist for various firms, honing his skills and building a reputation as a sharp thinker. In the 1950s, he co-founded Townsend-Greenspan & Co., an economic consulting firm that became highly influential in business circles. This guy was already making waves before he even stepped foot into government.

But here’s the kicker—Greenspan’s big break came when he joined President Gerald Ford’s administration in the 1970s. He served as Chairman of the Council of Economic Advisers, a role that put him in the spotlight and gave him valuable experience in policymaking. By the time Ronald Reagan appointed him as Chairman of the Federal Reserve in 1987, Greenspan was already a well-known figure in economic circles.

The Federal Reserve Years

Now, let’s talk about the big one—the Federal Reserve. Greenspan’s tenure as Fed Chair is often referred to as the “Greenspan Era,” and for good reason. During his time at the helm, he oversaw some of the most significant economic events of the late 20th and early 21st centuries. From the stock market crash of 1987 to the dot-com bubble burst, Greenspan navigated the U.S. economy through turbulent times with a steady hand.

One of his hallmark strategies was maintaining low inflation while promoting economic growth. This approach earned him widespread praise, and many credit him with keeping the U.S. economy stable during his tenure. But, as we’ll see later, not everyone agrees with that assessment.

Key Policies and Decisions

Greenspan’s time at the Fed was marked by several key policies and decisions that shaped the global economy. Here are a few highlights:

- Monetary Policy: Greenspan was a big advocate of flexible monetary policy, adjusting interest rates to manage inflation and stimulate growth. This approach helped the U.S. avoid several potential recessions.

- The Dot-Com Bubble: When the tech boom of the late 1990s started showing signs of overheating, Greenspan famously warned of “irrational exuberance” in financial markets. Although the bubble eventually burst, many argue his warnings were prescient.

- Post-9/11 Recovery: After the tragic events of September 11, 2001, Greenspan played a crucial role in stabilizing the U.S. economy. His decision to lower interest rates significantly helped prevent a deeper economic downturn.

These policies, among others, cemented Greenspan’s reputation as a master of economic management. But, as with any great leader, his decisions weren’t without controversy.

Controversies and Criticisms

Let’s not sugarcoat it—Greenspan’s legacy isn’t without its share of criticism. One of the biggest controversies surrounding his tenure is his role in the 2008 financial crisis. Critics argue that his decision to keep interest rates low for an extended period fueled the housing bubble, which eventually burst and led to the global financial meltdown.

Others point out that Greenspan’s laissez-faire approach to financial regulation allowed risky practices, like subprime lending, to go unchecked. In hindsight, these decisions may have contributed to the severity of the crisis. Of course, defenders of Greenspan argue that no one could have predicted the extent of the collapse, but that hasn’t stopped the debate from raging on.

Greenspan's Legacy

So, what’s the verdict on Alan Greenspan’s legacy? Well, it’s complicated. On one hand, he’s celebrated as one of the most effective central bankers in history, credited with guiding the U.S. economy through some of its toughest challenges. On the other hand, his policies have been blamed for contributing to the 2008 financial crisis, which had devastating consequences worldwide.

Despite the controversies, there’s no denying Greenspan’s influence on modern economics. His ideas and policies continue to shape how central banks approach monetary policy today. Love him or hate him, the guy left an indelible mark on the global economy.

Global Influence

Greenspan’s impact wasn’t limited to the United States. His decisions as Fed Chair had ripple effects across the globe, influencing central banks and financial institutions worldwide. For example, his approach to inflation targeting became a model for many countries, shaping how they manage their own economies.

Moreover, Greenspan’s insights and expertise made him a sought-after advisor long after his retirement. He’s written books, given lectures, and consulted with governments and businesses, sharing his wisdom with a new generation of economists.

Books and Publications

If you’re interested in diving deeper into Greenspan’s thoughts and ideas, check out his books. His memoir, “The Age of Turbulence: Adventures in a New World,” offers a fascinating look at his life and career. It’s a must-read for anyone interested in economics and finance.

Additionally, Greenspan has written numerous articles and papers on economic topics, many of which are still relevant today. His ability to explain complex economic concepts in accessible terms makes his work a valuable resource for students, professionals, and anyone curious about the world of finance.

Conclusion

Alright, folks, that’s the lowdown on Alan Greenspan. From his humble beginnings in New York City to his legendary tenure as Fed Chair, this guy’s story is nothing short of inspiring. Whether you agree with his policies or not, there’s no denying his impact on the global economy. So, what do you think? Did Greenspan get it right, or did he make mistakes that cost us dearly? Let me know in the comments below.

And hey, if you found this article helpful, don’t forget to share it with your friends. The more people understand economics, the better off we all are. Until next time, stay curious and keep learning!

- Wife Obituary Debby Clarke Belichick The Life Legacy And Age Of A Belichick Family Pillar

- Unveiling The Star Selina Vargass Journey In The Spotlight

Alan Greisman Movies, Bio and Lists on MUBI

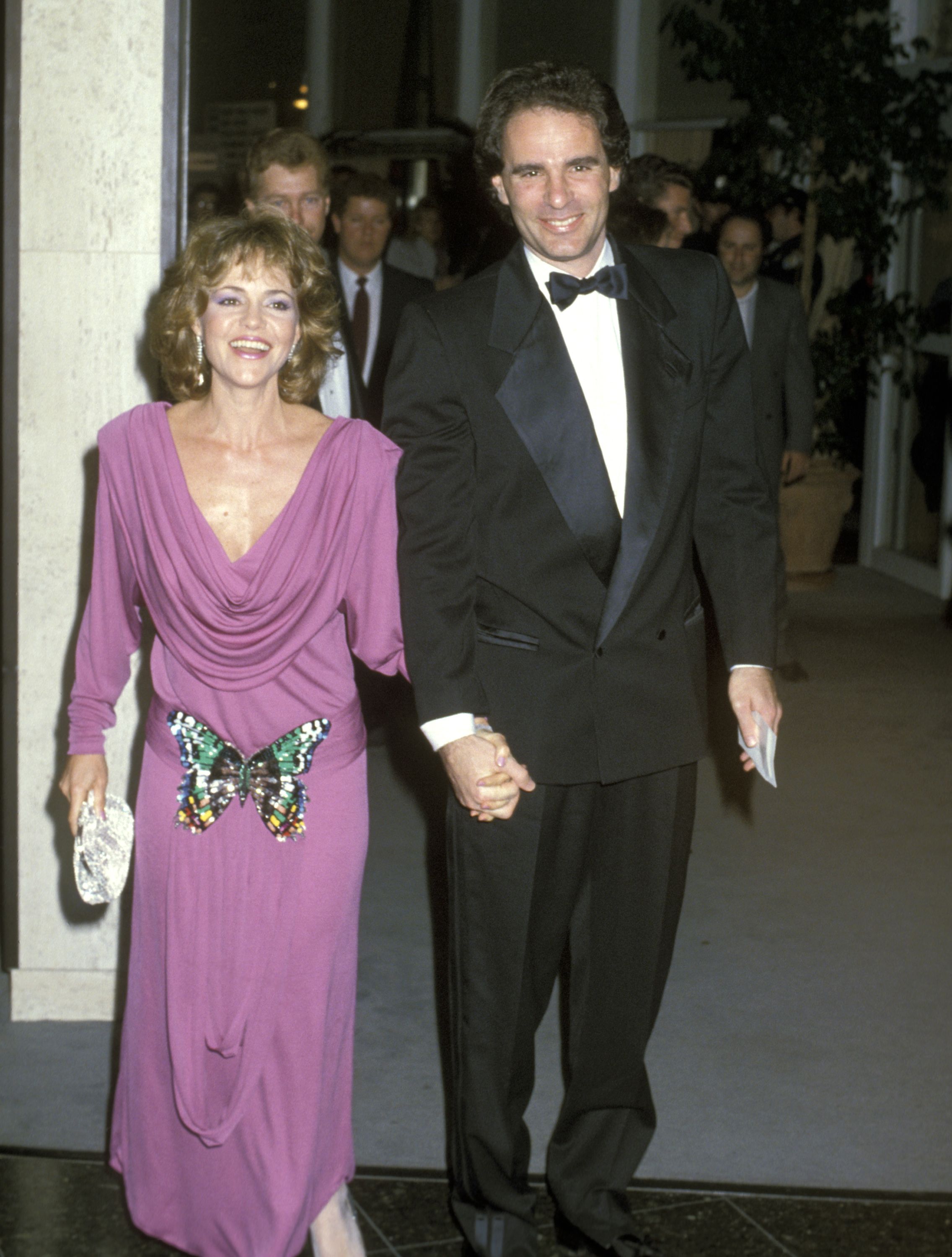

Pictures of Alan Greisman

Samuel Greisman Net Worth, Salary, Age, Height, Weight, Bio, Career